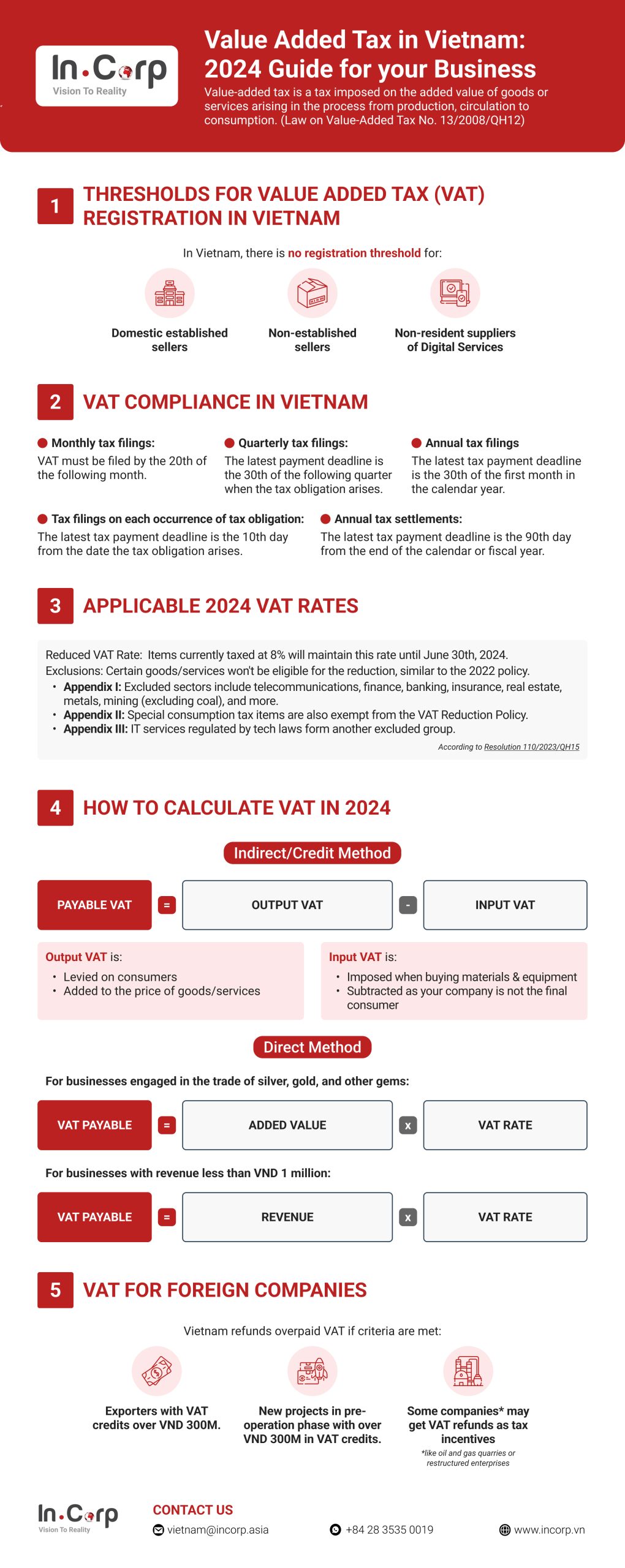

Value-Added Tax (VAT) is an essential tax for foreign businesses in Vietnam, levied on the added value at every production stage, from raw materials to final sale, and on imported goods and services. Unique to Vietnam, VAT registration is obligatory for all businesses, underscoring the importance of compliance in this market. Deadlines for VAT payments can vary, influenced by several business-specific factors.

Our 2024 guide offers a detailed look at Vietnam’s VAT system, providing foreign businesses with the insights needed to effectively navigate this crucial aspect of the Vietnamese tax landscape.

Download the PDF here: Guide to Value-Added Tax (VAT) in Vietnam for 2024

Value-Added Tax (VAT) in Vietnam is a critical component of the tax system, applicable to both local and foreign businesses. It is charged on the value added at each stage of production and distribution, covering a wide range of goods and services.

InCorp Vietnam encompass a thorough understanding of local tax laws, including detailed guidance on VAT and other tax obligations. We specialize in helping foreign enterprises adapt and thrive in Vietnam’s dynamic market through accurate financial reporting, efficient tax planning, and strategic compliance management. Partnering with InCorp Vietnam means securing a reliable ally for your business’s accounting and tax needs in Vietnam.

Find out more about InCorp Vietnam’s Accounting & Taxation Services in Vietnam

About Us

InCorp Vietnam is a leading provider of global market entry services. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,100 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business perfectly fit into the market with healthy growth.

Don’t take our word for it. Read some .