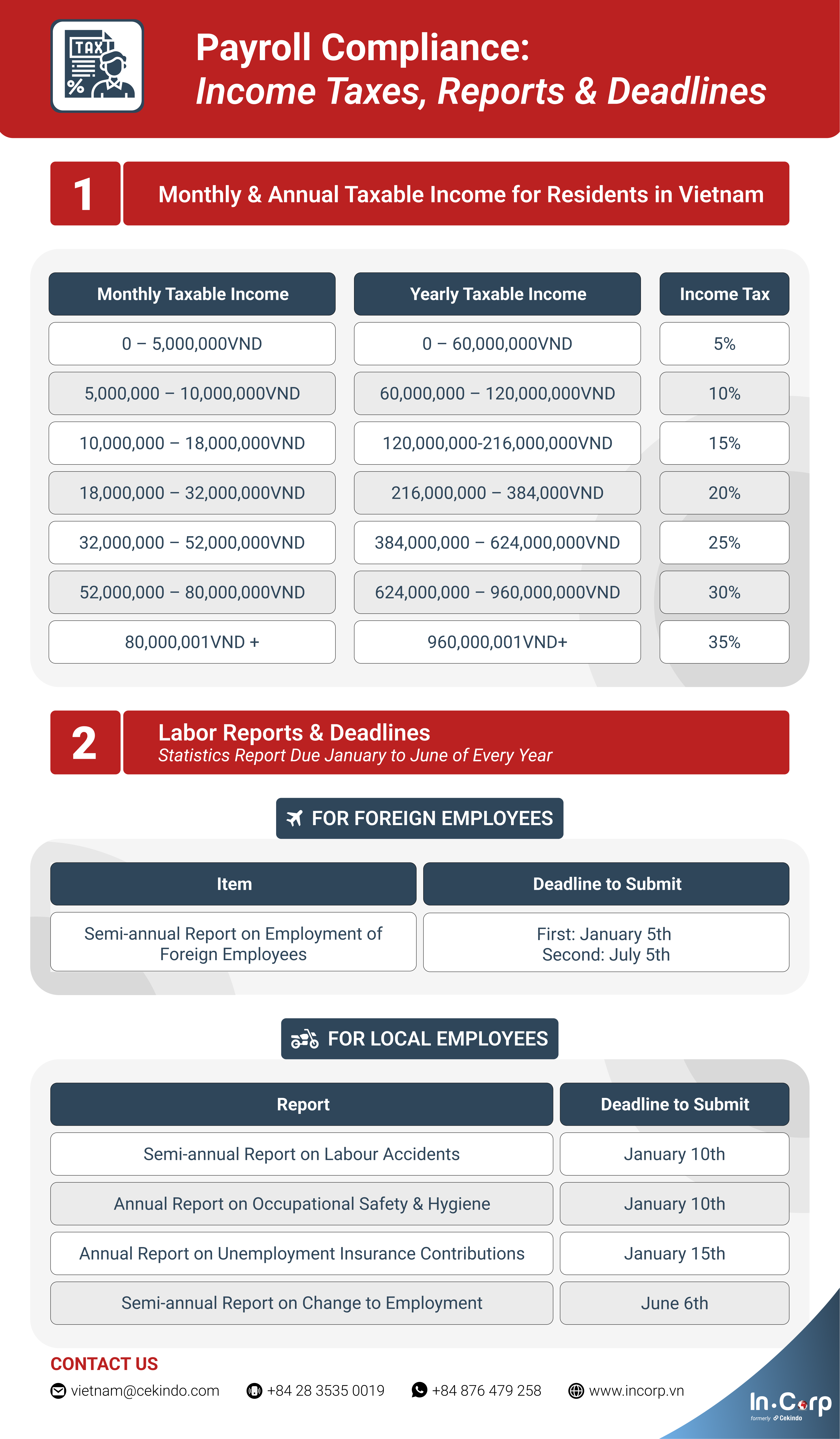

Payroll compliance is an important consideration for HR and payroll professionals. It’s critical to maintain accurate payroll records, including timekeeping and attendance procedures, and incorporate new regulations into your existing payroll processes. The infographic below provides basic information on monthly & annual taxable income for residents in Vietnam and labor reports & deadlines.

Download PDF here: Payroll Compliance: Income Taxes, Reports & Deadlines

Staying compliant with Vietnam’s payroll regulations requires careful attention to income tax brackets and adherence to reporting deadlines for both foreign and local employees. Whether it’s managing monthly taxable income or submitting labor reports, understanding these obligations is key to ensuring smooth business operations.

Still Considering about Payroll Compliance? Check out InCorp Vietnam’s Payroll Services

About Us

InCorp Vietnam is a leading provider of global market entry services. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,100 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business perfectly fit into the market with healthy growth.

Don’t take our word for it. Read some .