Vietnam’s jewelry manufacturing market bears a significant cultural and economic value to the country, making it a prospective environment for investment and business growth. Major global players (Swarovski, Pandora, etc.) have established a business presence in Vietnam alongside local public and private brands (PNJ, Cuu Long Jewelry, SJC, etc.).

For indigenous women, local textiles and jewelry represent the essence of their culture. That’s why many Vietnamese tribes have a deep cultural connection to silver jewelry. Certain pieces of jewelry can serve as markers of tribal identity while also acting as indicators of marital status, age, gender, and even personal qualities.

Traditional jewelry in Vietnam comes in various designs and forms, including rings, hairpins, combs, bracelets, necklaces, and earrings. Each group or tribe often has a unique design for each item. Some of these heritage jewels are extremely long-lasting and can be passed down through generations.

Tribal women typically wear two different types of jewelry: regular everyday pieces and special pieces (or ritual jewels), frequently made from silver. These days, jewelry is also seen as an instrument of savings that may be sold for cash when needed. Many women still believe that bronze and silver objects are capable of warding off evil spirits.

Starting a Jewelry Business in Vietnam? Check out InCorp Vietnam’s Incorporation Services

What Makes the Jewelry Industry in Vietnam Stand Out

Local Vietnamese artists used to produce jewelry as a small family business, primarily aimed at satisfying local consumer demand. Vietnamese buyers wanted simplistic jewelry designs that were more for savings and investment than for aesthetics.

Later, several jewelry makers started to update the designs of their products to satisfy the demands of younger generations who had been inspired by Western jewelry designs and aesthetics. Moreover, the popularity of international fashion products and trends helped increase the demand for jewelry. However, manufacturers needed advanced production technology, as their items were often of poor quality.

With the rise in demand for Vietnamese jewelry over the past ten years, the country’s silver production has expanded. The demand for jewelry in the nation is majorly inclined toward inexpensive silver products.

Since Vietnamese jewels are affordable but of outstanding quality and beauty, many tourists purchase them while on vacation as gifts for their friends and family.

How Vietnam’s Jewelry Have Grown

Period 1975-1988

Output of consumption: 5 tons/year

The gold market was formally shut down following Vietnam’s Liberation Day. Operations and manipulation in the business were kept secret and restricted to a small region.

Period 1988-2001

Output of consumption: 10 tons/year

Decree 33/ND-CP permitted the massive importation of gold bars and gold raw materials for manufacturing and trading. Moreover, it allowed the development of state-owned Gold & Jewelry firms like VietGold, SJC, PNJ, etc., at both the federal and regional levels.

Period 2001-2012

Output of consumption: 15 tons/year

With the setting up of DOJI Group (now one of the five biggest private enterprises in Vietnam), Decree 174/ND-CP encouraged the private gold and jewelry industry to create business products conventionally, luring numerous foreign businesses to invest in Vietnamese manufacturing facilities (Design International, Pranda, Tomei, etc.).

Consumption rose, and the gold content and quality were guaranteed, which eventually led to the opening up of jewelry stores all around the nation, including PNJ, DOJI, and others.

Period 2012-2018

Decree 24/ND-CP has helped to stabilize the gold market and made it simpler for big businesses like SJC, DOJI, and PNJ to grow their manufacturing and network on a national level.

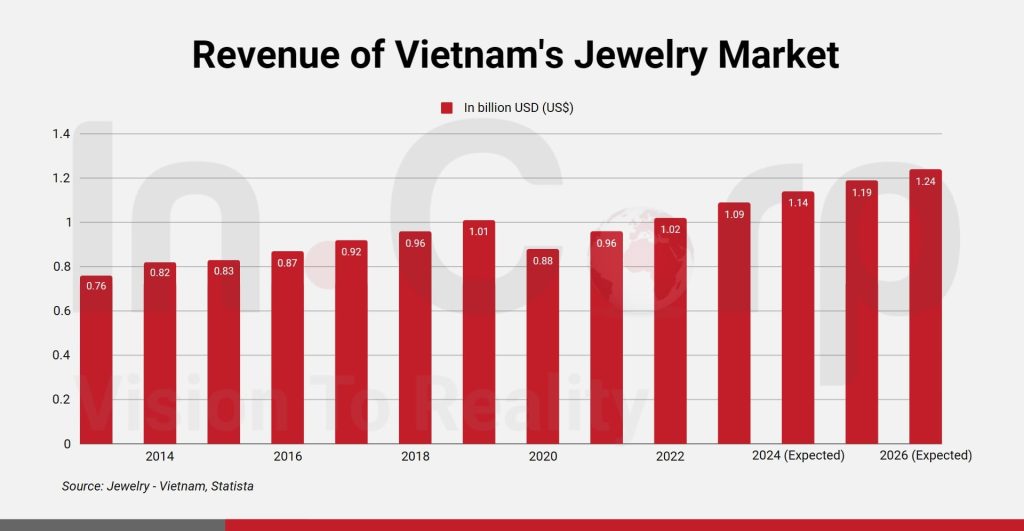

Vietnam’s Jewelry Market Value Exceeds US$1 Billion

The graph shows that the jewelry market was worth US$0.82 billion in 2014. By 2019, the market had grown to reach US$1.01 billion. However, due to the impact of the Covid-19 pandemic, the market value dropped back down to US$0.82 billion in 2020.

In 2022, the Jewelry segment has generally recovered and generated US$1.02 billion in revenue. Moreover, the market is anticipated to expand by 5.02% yearly (CAGR 2022-2026). It is further believed that from 2022, non-luxury jewelry will account for 84% of sales.

Recent Trends in the Jewelry Market

The number of businesses trading in jewelry was nearly 8,000 in 2015; by the end of 2022, this figure has risen to 10,000. Yet, only around ten homegrown brands have become household names.

Vietnamese enterprises are facing pressure due to the presence of well-known international high-end jewelry brands. Local companies are in a radically inferior position to foreign brands in shopping centers like Diamond, Parkson, and Zen Plaza.

Foreign jewelry brands mostly distribute their products through shopping malls and solely target the high-end market, whereas most Vietnamese companies only have tiny retail storefronts. Without enough brand awareness, they cannot establish themselves in malls. However, they are deeply aware of the domestic market and manufacture products that are more in line with consumer preferences. Hence, economists think Vietnam’s gold and jewelry business has much unrealized potential.

The COVID-19 pandemic has caused the jewelry sector to struggle during the last three years. According to statistics, the consumption of jewelry in Vietnam was 7.9 tons in 2020, down 41.45% from what it was in 2019.

Keeping in line with the global decline, the Vietnamese market is contracting, but it is doing relatively better than several other nations in Southeast Asia, including Indonesia, Singapore, and Thailand.

We made the most detailed step-by-step guide for Company Incorporation in Vietnam for investors, now available as an interactive checklist:

Supercharged demand for gold

According to a report on demand trends from the World Gold Council (WGC), the nation’s demand for gold was predicted to reach 14 tonnes in the second quarter of 2022.

During that time, demand for gold bars and coins increased by 5%(9.6 tonnes), while demand for jewelry rose by 28% (4.5 tons).

The World Gold Council’s Andrew Naylor, Director of ASEAN and Public Policy, claimed that the strong increase in jewelry demand compared to the same period last year could also be attributed to 3 main factors:

- A sharp drop in domestic gold prices

- The cautious optimism of consumers amidst a resounding global economic recovery

- The government proposing a stimulus package of US$15 billion to bolster economic growth.

According to a WGC analysis on personal gold investment in Vietnam, the country was among the top 10 gold-consuming markets globally and the largest market in Southeast Asia in 2021. More than 80% of people surveyed who bought gold in the year 2021 said they might buy more in the future. The figure was higher than the 45% average for all countries.

The survey also reported that investors have a strong interest in gold because they think that it can provide financial security in the long run by combating inflation and currency volatility.

There is a huge demand for gold in the nation. The country’s financial system’s growth is expected to result in the growth of the gold market, boosting both accessibility and the confidence people have in gold.

According to the 2022 Q2 report, gold demand was 8% lower (YoY) at 948 tonnes. However, the demand in 2022 (H1) increased by 12% (YoY), clocking 2,189 tons.

High appreciation for durability

According to a survey of consumers, product durability is the key consideration when it comes to making decisions related to buying jewelry. Consumers are being more careful when picking jewelry materials and are prepared to pay high prices if they believe the jewelry pieces to be durable.

By 2021, Vietnam’s per capita GDP had already surpassed US$3,700. The demand for gold and silver will rise exponentially as the number of middle-class individuals increases. Many consumers, particularly young ones, also need jewelry and accessories to express their style and personality. As a result, they have high standards for diversity, richness, and variation in designs, materials, and product categories. They are also constantly innovating and experimenting with new styles.

Price is the most significant decision-making element, accounting for approximately 23% of shopping decisions, according to a Q&Me study on fashion purchasing habits.

E-commerce to play a big role

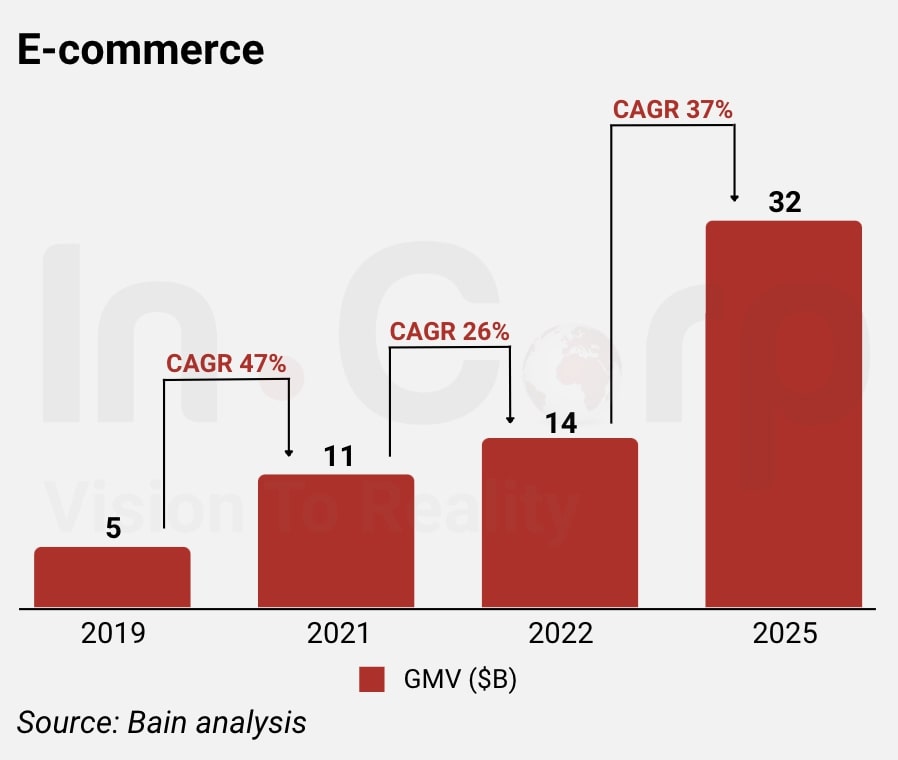

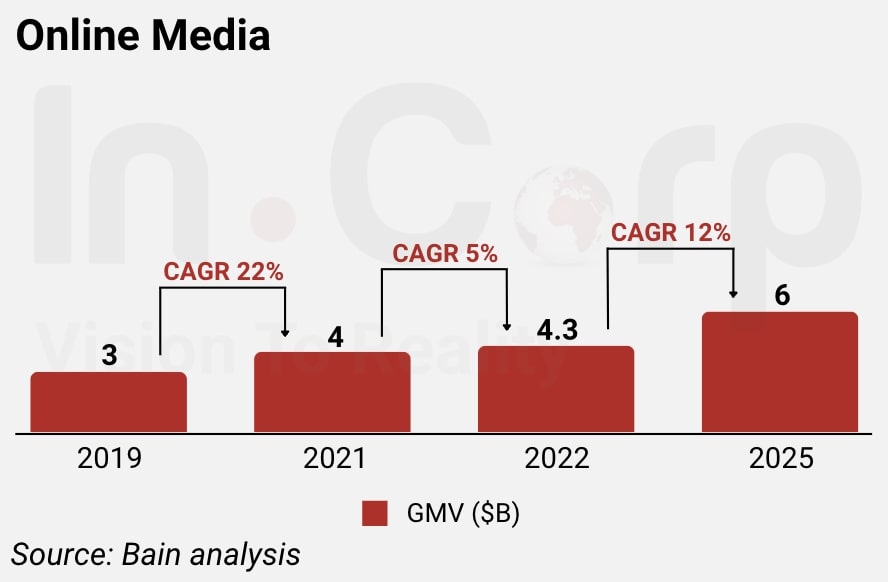

Vietnam’s digital economy has clocked US$23 billion in 2022 and is expected to double by 2025. Factors like booming e-commerce and the rise in the use of online media make Vietnam one of the fastest-growing economies in the SEA region.

Here are the past and projected compound annual growth rate (CAGR) for the e-commerce sector:

And for the value of online media:

Key Players in Jewelry Manufacturing

PNJP – The leading jewelry manufacturer in Vietnam

Phu Nhuan Jewelry Joint-Stock Company, which was founded in 1988, is one of the top jewelry makers in Vietnam and specializes in making gold and silver jewelry, as well as gemstones, fashion, and crafts. As the third-largest jewelry firm in the world and one of the Top 500 retailers in all of Asia, PNJ is dedicated to giving customers the best quality products at competitive prices.

Their factory can create up to 3 million pieces annually while maintaining a high level of quality thanks to 680 skilled staff and contemporary machinery from Germany and Italy. Its current export markets include the USA, Australia, Denmark, Germany, and France.

Website: https://export.pnj.com.vn/

Bien Bac Jewellery

Bien Bac Jewellery, one of the most prominent jewelry stores in Hoi An’s old town, opened its doors to the public in 1997. The business has constantly grown in popularity among its clients, including both locals and foreign tourists, year after year.

Bien Bac Jewellery aims to satisfy their customers’ expectations with their quick service for everything from purchasing in-store jewelry pieces, such as gold/silver bracelets and rings, to fulfilling any custom design demands, such as necklaces, earrings, pendants, bangles, and cufflinks.

Website: http://bbjewellery-hoian.com/

Handmade Buffalo Horn Jewelry

The company is a manufacturer and exporter of environmentally friendly handcrafted home decor and fashion accessories in Vietnam. The product line includes a wide variety of handmade jewelry suitable for both everyday wear and special occasions, including necklaces, bracelets, earrings, rings, pendants, hair accessories, spoons, forks, and more.

Website: https://vietnamhornjewelry.com/

Saigon Jewelry and Accessories Company (SAJA)

The company specializes in precious gems, feng shui crystals, silver jewelry with gems, and unique handmade products. On top of manufacturing, it also handles imports and wholesale, and has expanded its reach to overseas markets and its products are now available in key countries in North America, Europe, Asia-Pacific, and Australia.

Website: https://saja.trustpass.alibaba.com/

Ant Jewelry

A Vietnamese company that deals in wholesale fashion jewelry. Moreover, they manufacture and export a wide range of sterling silver and gold diamond jewelry. Their vision is to become a market leader in Vietnam that specializes in silver and platinum jewelry.

Website: http://antjewels.com/

Vietnam International Jewelry Fair

The Vietnam International Jewelry Fair is a premier event in the jewelry industry, offering a platform for manufacturers, wholesalers, and retailers to showcase their latest designs and collections. With a diverse range of exhibitors from around the world, this fair is a great resource for businesses looking to connect with new manufacturers and expand their network in the industry.

Website: http://www.vietnamjewelryfair.com/

About Us

InCorp Vietnam is a leading provider of global market entry services. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,100 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business perfectly fit into the market with healthy growth.

Don’t take our word for it. Read some .

Verified by

Ian Comandao

Business Consulting Manager at InCorp Vietnam

Ian is a sales and marketing professional who has worked over 15 years in key accounts management.