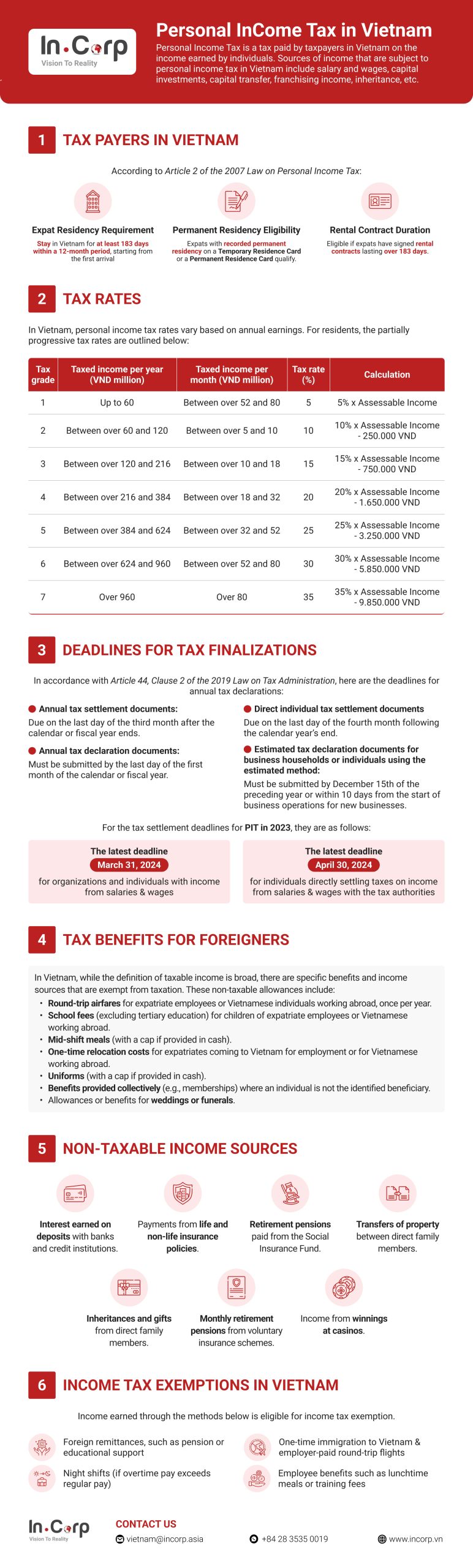

Personal Income Tax in Vietnam is levied on individuals’ earnings, including salary, capital gains, and inheritance. Expats must meet residency or permanent residency requirements to be taxpayers.

Foreigners in Vietnam enjoy tax benefits, including exemptions for airfares, school fees, and certain allowances. There are exemptions for foreign remittances, night shift income, and employer-provided benefits.

Discover the essentials of Personal Income Tax in Vietnam with our visually engaging infographic below.

Download the PDF here: Personal Income Tax in Vietnam: An Infographic Guide

Understanding and complying with PIT regulations are crucial for both local and foreign individuals working in Vietnam. InCorp Vietnam stands as a leading provider of comprehensive Accounting and Taxation Services tailored to the unique business landscape of Vietnam. Our expertise spans across critical areas including payroll processing, financial reporting, and navigating the complexities of Vietnam’s tax system.

Check out InCorp Vietnam’s Accounting & Taxation Services in Vietnam

About Us

InCorp Vietnam is a leading provider of global market entry services. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,100 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business perfectly fit into the market with healthy growth.

Don’t take our word for it. Read some .